Find us here

The team at THIS R&D are passionate about R&D Tax Relief and would like to change the statistics which suggest that 7 out of 10 businesses are missing out on this form of Tax Relief. Our work practice seeks to achieve this, firstly by understanding the nature of a businesses work and thereafter assessing its ability to qualify for R&D Tax Relief. This is a process of cooperation.

69

Project Value

Project Details

Industry: Commercial Electrical

Project Date: January 2021

In January 2021 THIS R&D undertook an analysis of a Commercial Electrical Contractor, who had never claimed R&D Tax Relief before. After a 1 hour Zoom call, qualifying R&D expenditure was identified in projects involving work on grade I listed properties and the implementation of new services within them. The parties began to work together to understand if further qualifying expenditure could be identified. This was subsequently found in a different area of the business which creates fixings for the installation of equipment on work sites.

The costs relating to the work undertaken by the business over the last two financials were apportioned by THIS R&D resulting in an R&D claim of 69K as a cash rebate. This was approved by HMRC 26 days after submission. In total this claim took up less than 2.5 hours of the clients time. This is because the team at THIS R&D write the technical report for R&D claims and also amend the Corporation Tax returns that accompany a submission.

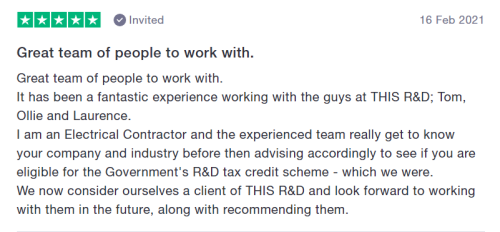

If you would like to understand if your company can retrospectively claim R&D Tax Relief and perhaps continue to do this into the future please get in touch with us. We trust the review that we received from our client below shows our willingness to understand all businesses and to realise the untapped value within them.